Can the Climate Change Crisis lead to a new financial crisis?

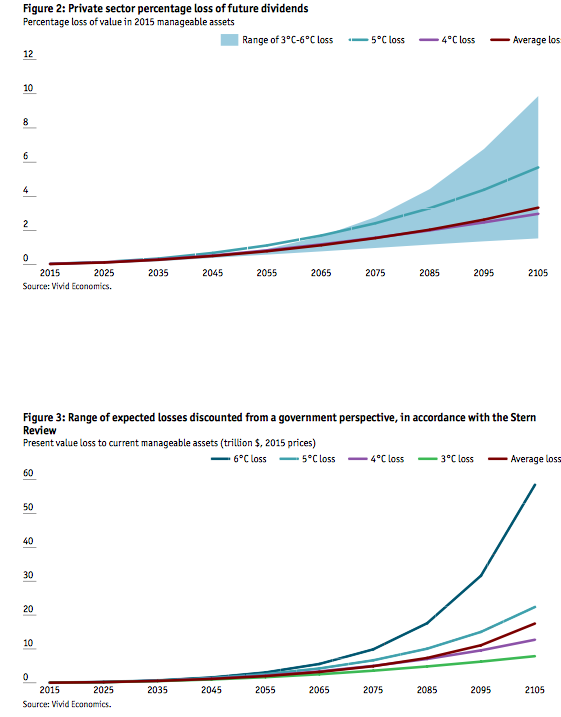

It must be clear climate change will affect every aspect of our society and economy! This includes the stock market as well! According to a study conducted by the Economist there is a huge cost associated with climate change for the financial players. The value at risk from climate change estimated is 4.2$ trillion to the 2100 horizon. We must recall that the current total manageable assets globally are 143$ trillion. However to give you a rough idea, 4.2$trn are as much as Japan’s entire GDP!

What is the value at risk?

The value at risk (VaR) is a measure of the risk of investments. It estimates how much a set of investments might lose, given normal market conditions, in a set time period such as a day.

However, when it involves climate change impact, there is one thing to highlight: the losses are irreversible and permanent!

The financial crisis we have experienced so far brought about catastrophic aftermaths, but we have been more or less been able to recover that losses, Here there will be no chance of doing that!

As the risk is concrete many have already taken action: France amended a law requiring managers to take into account in their own portfolios the climate-related risks. Many pension funds are using the Investing, Engaging and Divesting formula. Investors are identifying companies that best will benefit from a transition to a low-carbon economy and that are environmentally concerned. Moreover, they are using engagement as a tool to change the way to do business in the company they invest in, that still have carbon-intensive activities. Lastly the are cutting assets in companies that represent high climate change risk in the long and short term, giving a stark signal to the public as well!

Governments as well are required to take action, as their cost is considerably higher than the private sector and they will experience more difficulties in making their portfolios more environment-friendly.

As the Economist’s study concludes :“there is a clear need for co-ordinated action by regulators, governments and institutional investors in order to address the long-term, systemic risks at play. Climate risks need to be assessed, disclosed and, where feasible, mitigated.”