Linked both to COVID-19 spreading and to the already existing tensions between oil-exporting countries, the price for May’s West Texas Intermediate (WTI) futures fell to -37.63$. In other words, owners of “futures” contracts of American Crude Oil paid up to 37$ to get rid of their own stocks.

With an in-depth introduction to explain the framework of this event to our new readers, we will propose our forecast divided into several scenarios that will affect both the Global Consumer Economy and the Renewables Market.

First of all let’s split the topic into several definitions.

West Texas Intermediate: WTI is a high-quality light oil extracted by USA private (but subsidised) companies that operate over the Permian Basin, an oil field that covers Texas and New Mexico, that is also the main source of Oil for the USA, as well as one of the three biggest benchmarks for oil prices worldwide. WTI storage and distribution system consists of 24 pipelines and 15 storage terminals (13% of USA oil storage) with a capacity of 90 million barrels.

Futures Contract: Is a legal agreement to trade a commodity (physical good) or security (financial instrument) at an established price at a given time by two or more parties. To easy the transactions, quality and quantity are standardize. Futures can last for less than a year, others for more than ten years. In these period futures are traded in Futures Exchange by brokers and commercial traders than bid on ups and downs price trends. Here comes an important aspect: When the futures contract expires, the final buyer is taking on the obligation to receive and take care of that asset. This means that if May’s WTI futures expire on 20/04/20 the holder of such futures must pay the cost related to the physical product storage and distribution.

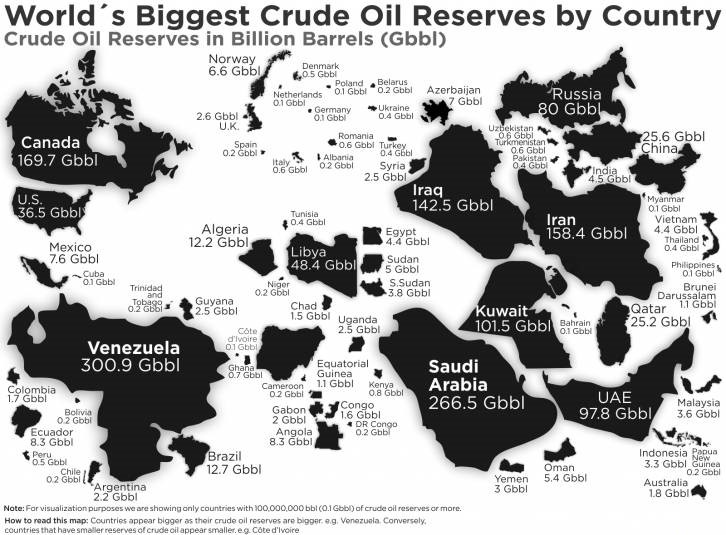

OPEC: The Organization of Petroleum Exporting Countries (OPEC), a de facto international cartel protected by the legal doctrine of Sovereign Immunity, is an articulated set of National States who share similar economic inputs that, under the form of a coalition, try to regulate themselves with respect to the generation and management of oil outputs. OPEC in 2018 accounted for 44% of oil supply worldwide and 82% of proven reserves. Rentier states that rely on one main export have ensuring price stability, rather than production diversification, as an effective policy for risk reduction and national security. With proper coordination, OPEC was, for most of the industrial history, able to set prices higher than the competitive outcome. OPEC annually releases production quotas to limit production and ensure high Oil prices.

Nevertheless, in certain situations quotas negotiation could go against one National State’s economic policy, that might with to be more expansive in production, therefore lowering prices. This happened in 2008, where the oil price shifter from 107$ to 52$ per barrel (recall WTI yesterday was -37$) for a dispute between other OPEC countries and Saudi Arabia.

The present outcome was again part of a dispute in which Saudi Arabia took part. At the beginning of March, Russia tried to establish an agreement to keep oil prices high by limiting production.

Russia is also the first exporter of Natural Gas Liquids to Europe. Being Oil and Gas substitutes, as oil price goes down, the NGL price also tends to decrease.

To this manoeuvre, Saudi Arabian Oil Corporation answered by boosting production to 12.3 million barrels a day (+300.000 x day) leading to a price cut. This response might be explained by Saudi attempt to diversify their economy, with an all-in/all-out strategy as well as by rising political tensions in the Middle East after Soleimani’s assassination. At the same time, global pandemic harshly cut oil demand by limiting freedom of movement across the globe, cutting demand to an unimaginable extent.

Having these background on hand, we can now sum up what happened yesterday in the financial market an how this might affect the future supposing several scenarios.

On 20/04/20 US national Crude Oil Storage, regardless a stop in production was reaching its limit due to the demand fall caused by COVID-19. In this same date, WTI futures were expiring, giving to their last owners the obligation to take responsibility for the physical commodity. Given that no storage company was intended to buy WTI, prices went as down as they could, reaching an unimaginable negative outcome: -37.63 U$D. Those brokers who possessed WTI May futures were paying money to get rid of those barrels of oil because no market was intended to buy the product.

Today WTI futures closed at +24.72 U$D, this rise in price is due to the fact that today we are talking about June’s WTI futures, that will expire next month. Other futures of longer duration are also available in the market at higher prices.

Yet, if demand doesn’t increase again, next month in this same period we will likely face a similar scenario, with prices going as low as close to 0.

While we are not in the position of stating if raising USA’s citizen rally against lockdown has anything to do with Oil lobbyists (whose in a relevant portion are financing Climate Change denials) nor getting into current OPEC negotiations, what we can do is trying to foresee three different scenarios, that might affect both the global economy and the renewables market in different ways.

- Short term (1 year): If the oil crisis has a short term end, the sector will likely face a period of recession (loss of jobs, closure of some small and middle enterprises). Later on, it will likely be reconstructed with public funding both in OPEC countries and other Oil dependent Nations as USA and Russia. This scenario might coincide with the reopening of most activities across the globe once a vaccine for COVID-19 will be provided in rich countries. As the effect will not change long term investments, the renewables market won’t get affected.

- Medium-term (1 to 10 years): Here we must distinguish two different effects. COVID-19 might affect patterns on consumption studied by behavioural economists. Consumers might tend to travel less, companies might implement smart working to a greater extent, limiting oil consumption across the globe. This will likely make most small to medium oil businesses unprofitable leaving them out of the market. Nations with state-owned Oil reserves (as OPEC Countries) will likely cooperate to run near Break-Even Point while the demand remains low, having no losses but no substantial profit, while diversifying their economy to other sectors, as part of Saudi Arabia (mainly Dubai) has been doing in the last ten years. To these considerations we must add that higher concern regarding Climate Change has made polluting investments less profitable, diverting future investments and Research & Development activities from the oil sector to other energy compartments. On the other side, needing a push for Global Economy Reconstruction, Nations might be tempted to rely on low oil prices to restart industrial activities. On this matter, Europe mast acts quickly for ensuring a European Carbon Tax to avoid this dangerous mechanism. Depending on which of these two outcomes will occur, renewables might see a brighter future or rather be out of the market for a longer period of time.

- Long term (more than 10 years): The third scenario will likely be de more damaging, while also the most intuitive. If Monopolistic Competition occurs at low prices for a sufficiently long period, with enough state funding to keep oil extraction going, renewables will be out of the market, regardless of any investment to reduce their costs. This would have dramatic effects on our planet and our health as well.

While we cannot predict whether or not these scenarios will prove correct, nor which of those will be most likely to happen, what we can assure is that political and entrepreneurial decisions must be taken at European and Global level to:

- Avoid Oil energy State-based refunding (that doesn’t look at Return On Investments but is more dependent on lobbying power)

- Have efficient legislation on the establishment of a European Carbon Tax and “Green Tax Concessions” for Small and Medium Enterprises.

This Pandemic shall be the pivoting demarcation line from a Carbon-Based, to a Circular Economy. The Time to Act has come.