Introduction:

With the European Union enacting the Emission Trading Scheme (ETS) in 2005, studies over multilateral agreements that aim at reducing pollution acquired useful empirical evidence. Putting a price on carbon emission alone will not be enough to stop the global emission trend in the medium-long term. The main controversy to deal with is Carbon Leakage: a backlash effect that causes “CO2 reducing regulations” in Country A to trigger an increase in emissions elsewhere. Such a phenomenon shifts environmental damages to the geographic South and hinders jobs stability in Northern Countries by relocating factories.

In this review, I will assess both effects and postulate why a Carbon Tax and Dividend might cancel such effects from the overall equation.

“Clean air” is the common good at the centre of the discourse. Two characteristics make its analysis controversial: its trans-territorial nature and a reversed approach to its economic assessment. In other terms, rather than direct clean air appraisal, we deal with the evaluation of “polluting externalities”.

To elaborate on this essay, readers should view Carbon Taxes as policies to reduce such negative externalities, which affect both human and climate health.

The discourse will review current policies effects in Europe, addressing outweighing factors and offering potential alternatives.

EU Emission Trade Scheme (ETS):

The rationale behind EU ETS is to endorse technological investments across Europe towards “green technologies”, as a foreseeable increase in carbon costs will negatively adjust the economic value of emission-intensive goods.

Yet, given market and lobbying powers by Emission Intensive and Trade Exposed (EITE) Corporations, governments are induced to emit high cap of free allowances, also to avoid threats of both facility and legal relocation.

Furthermore, such “carbon cap and allowances” measures alter demands of fossil fuel. A reduction in demand in the regulated Country will eventually lower fuel costs in deregulated countries in an open economy.

Going into academic papers: such phenomenon can be furtherly exacerbated by monopolistic market power exerted by legal cartels as OPEC (Andrade de Sà & Daubanes 2016).

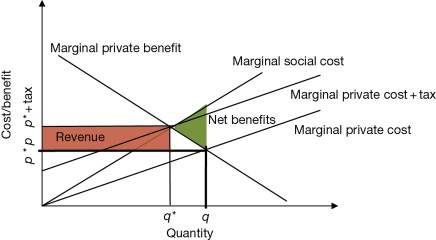

As demand is relatively inelastic for energy commodities, monopolies deter high-potential substitutes (i.e. natural gas) in order to set higher prices in the market. Under Carbon Taxation, monopolies can benefit their “incumbent” position by applying “predatory pricing” to the expenses of “early entrants”. In other words, Carbon Pricing may reduce total welfare. To counteract to such market distortions a proper allocation of subsidies must be done. Here, I postulate the alternative of Carbon Fee and Dividends to counterbalance such “market failures”.

Concerning a traditional Carbon Tax, which adds a cost for recovering the negative externalities of CO2, several studies proved social inefficiency of this approach in both the overall economy (Kunkel et al. 2011) and specific sectors, as agriculture (Dumortier & Elobeid 2020). The main argument (Kunkel et al. 2011) postulates the regressive nature of “carbon pricing”, as lower-income households spend a higher fraction of their salary on energy.

Consequently, the current debate amongst economists is focused on how to reuse carbon revenues from taxes, to minimize the regressive impact on income distribution (Dissou & Siddiqui 2014).

We can conclude the preliminary nature of the EU ETS, which couldn’t work by just reducing lobbying and monopolistic powers and blending discretional national jurisdictions through international negotiations.

Urges a political debate to turn this measure from regressive to progressive.

Double Dividend and Tax Allocation:

In this line of reasoning, measures that apply the “Double Dividend”, being an economic effect that both reduces environmental harm (1st dividend) and social costs (2nd dividend), shall be enacted.

The general assumption that we concluded, is that a regressive measure, such as a Carbon Tax, will have positive effects on environmental damage compensation while having a negative distributional effect on households. To counter the latter consequence, policymakers might want to offset the social costs of lower-income families when facing a carbon tax by moving such revenues to welfare plans and reducing other distortionary taxation from the economy.

As this debate went forward in the United States, “carbon tax” was regarded as a substitute to eliminate “corporate tax” and “income tax”. Furthermore, some scholars (Pezzey & Park 1998) argue that environmental “command and control” policies and regulation are detrimental to the economy, finding a “Carbon Tax and Double Dividend approach” a proxy to stop developing environmental regulations.

While this is the main line of thinking in the USA, European research mostly focus on implementing a carbon tax without compromising environmental regulations and complemented by welfare-enhancing policies rather than tax cuts.

In Freire-Gonzàles & Ho (2018) several hypotheses of double dividends have been analysed for Spain. As a result, the “American Hypothesis” of reducing capital tax, labour tax or VAT, revealed efficiency on a GDP basis only for low levels of carbon taxation (10 to 20 € CO2 / ton).

Sticking out of the GDP benchmark, a Carbon Tax of 30€ per CO2 / ton, while having a 0.1% GDP reduction, would positively alter many other indicators that are not encompassed by this traditional measure (i.e. human, animal and ecosystem health). In all these double dividends scenarios, a sectorial evaluation can be made: EITE industries (i.e. energy producers) are worse off, while both labour and other capital-intensive industries are better off.

Tezuka et al. (2002), took an approach that is worth mentioning: rather than traditional Computable General Equilibrium (CGE) models, they proposed a reallocation from carbon taxation to subsidies for Photovoltaic Power Generation Systems (PV) on houses. As a result, with GDP maintained constant, a tax of 2000 yen per ton (about 20€) would cut the“amortization” (repayment) time for PV systems in half. This would make investments towards PV double rewarding than fossil fuel stocks.

The biggest limitation of this analysis resides in the nature of the Carbon Tax itself. As the industrial economy relies on carbon-intensive goods, such a measure will inevitably affect the GDP, as well as showing upscaling regressive consequences on lower-income households.

The impact of a Double Dividend approach will slightly change depending on which measures are going to be funded by such revenues.

As governmental bodies face inner conflicts between the treasury and the “spenders”, as EITE industries exert significant lobbying power, and as the political agenda answers to volatile interests, we can conclude that from an empirical perspective the allocation of revenues from carbon taxes is so critical that only a well-prepared political class could handle.

Carbon Fee and Dividend:

If the rationale of the Double Dividend is to lift citizen from both environmental and socioeconomic burdens, and if an indirect allocation through Welfare Policies might be too discretional and subject to political agenda, how would the scenario change if the revenues received from Carbon Taxation were to be given directly in the hands of the citizen through a monthly “dividend” or “income”?

Studies in-loco, like that made in California by Kunkel & Kammen (2011) acknowledged the progressive nature of a “Climate Income”, with a short-to-medium term decrease in consumption of fuel and increased profitability for less-to-no polluting alternatives.

Kunkel & Kammel (2011) also proposed a “blend” alternative, with the opportunity of giving a dividend to only the last two quartiles of the population while withholding 80-90% of revenues for welfare purposes. Such an alternative would still fully compensate that half population, yet without any positive “green- free rider” effect.

In other words, giving 100% of the revenues to the population could further affect demand elasticity, making low-income families revert to responsible consumption choices in order to benefit a “free-riding effect” from the more inelastic demand of higher-income households.

To sum up: a “Climate Income” approach is less dependent on political decisions concerning welfare equalisation, while, on the other hand, more legitimising towards individual citizen decisions.

Ostrom’s Approach:

Given these definitions and preliminary reasoning, in order to assess the emphasis of “Climate Income” on democracy, one should review both Traditional Carbon Taxation and Climate Income under an approach focused on environmental governance.

To begin with, even if economic externalities must be evaluated under a macroeconomic approach, it is the same nature of “pollutants” that imposes an approach as we were managing commons. In this regard, there is nothing more democratic than pollution.

Assuming a lack of mediation from the State, we can use Ostrom’s approach as reviewed by Acheson (2011). Within this framework, air can be regarded as a common-pool resource if we consider its subtractability as a by-product of polluting activities.

If for collective action dilemmas the key factors for a “Pareto efficient solution” are solid trust and clear punishment, Carbon Pricing can be viewed as a “punishment”. Trust for compliance would come along in a Climate Income scenario, as the “punishment fee” would be directly collected by the compliant citizen. In these terms, the positive or negative payoff of “conditional co-operators” and “rational egoists” would depend on their monthly choices of consumption.

Income received from the State, as a counterbalance for carbon pollution, is a dynamic, democratic and legitimising input for individual choices in welfare-enhancing actions. On the other hand, we could view Carbon Tax as institutionalising damage compensation, as in Hardin (1968).

To analyse Climate Income under Ostrom’s framework, we can approach it with the syntax to analyse rules that she theorized in Crawford & Ostrom (2000):

- Attribute (to whom the rules apply): as we will review in the next chapter, this is most likely the hardest decision. While clean air is a worldwide common good, not easily distinguishable and divisible through the concept of territory, two question arises:

- Will it be enough if only certain States’ jurisdiction apply the rule?

- Will the rule by applied to formal citizen, taxpayers, inhabitants? Under which limitations of age and legal status?

- Deontic (what is permitted): as a market-based measure rather than a command and control one, is the rising cost pressure exerted on the elasticity of demand is the only limitation on common goods’ access?

- Aim (outcome to be reached): a reduction in CO2 harm (as a proxy for general pollutants) with a progressive approach on income;

- Conditions (when an action is permitted): for the same logic as the deontic component, a market-based approach has empirically proven its successfulness within this globalized economic framework. For this, market forces are the only applying conditions for this measure;

- Punishment: as for the second and fourth component, punishment is encompassed by market forces.

As this set of characteristics is rather intuitive, one would ask about the obstacles for such a measure. We shall pick some relevant aspects of governance in order to assess limitations and other critical issues.

Limitations and Critical Issues:

- Citizenship:

From a European or United States point of view, the concept of citizenship opposed to those of “illegal immigrants” would pose a problem of lawfulness.

Some Sub-Saharian, Middle East and South American countries would instead suffer the consequences of their weak States’ institutions. In both frameworks, with rising migrating populations, the same traditional concept of citizenship hinders the legitimacy of a measure such as Climate Income.

From a conservative perspective, one could argue that such a measure if only applied to legal citizen would restrict illegal immigration. Yet, a more down to earth view would acknowledge that this poses two main problems: both those “aliens” who already live within the nation’s territory and emigrating populations that already suffered the damages from climate distress would not benefit from a measure that should be primarily addressed to them.

As they lack representation in the European political system, it is rather difficult to enact a Climate Income policy broadly, resulting in the exacerbation of differences.

In the immigration scenario, mutated over time in a second generation of “citizen without citizenship”, we face a lack of institutional representativeness that, according to Fisher (2016) can be blended by empowering informal institutions, for a slow transformation into formal bodies. Even if a depthless solution, I identify SPRARs and NGOs as two contingent bodies that might be empowered to address this inequality issue in a preliminary moment. For the latter case (“citizen without citizenship”) a more profound political discourse is needed.

- National vs International Jurisdiction:

We face a two-layered problem: in Northern Countries, too strong States’ authority hinders the legitimacy of migrant populations over their right for compensation. On the other hand, in several Southern Countries, we encounter weak state authority challenged by “twilight institutions”.

In Lund et al. (2006), the situation is depicted for African countries, where overlapping institutions might hinder the possibility of international agreements.

Yet, I argue that focusing on a macroeconomic approach, Climate Income aims at reassessing negative externalities for production, making it fore suitable for Northern industrialized countries.

Here arises the dilemma of whether this measure of Climate Income should be limited to northern countries for simplicity.

An approach like this, while efficient on macroeconomic terms, forget the existence of Carbon Leakages that would reallocate factories to Southern Countries were environmental regulations are not as strict.

Sharing a dividend payment across countries, instead, would cancel the benefits for low-income households in Northern Countries.

A middle-ground approach, as having the top two quartiles of national population renouncing the income revenue in favour of welfare-enhancing plans abroad would also have its backlashes by slowing the demand for less-to-no polluting energy sources.

The inextricable bond between Northern private corporations and Southern foreign States, as well as other trade regulations governing transnational commons, (i.e. EU IUU Regulation no. 1005/2008), induce to think that horizontal international agreements on this matter will be unlikely. (Miller et al. 2014) Both market and normative power will empirically put Northern Countries in an advantageous position, leaving only “aid” plans on the agenda, substantially harming mutual trust.

Yet it must be said that there are no measures that can be used as a solution for everything (Folke et al. 2010, Acheson 2011), as an unexperienced political class might be tempted to think in the environmental context.

Restricting Climate Income to national inhabitants should not be seen as defiance.

Critical issues will arise to avoid leakages of “dirty production”: it will be inevitable to negotiate trade adjustments with southern countries and other non-compliant partners.

- Individualism and Collective Action:

A more theoretical criticism lies in the nature of Climate Income. As understood by Hornborg (2013), the common narrative

on social-ecological systems stress the need for the population to develop resilience thinking.

A Carbon Dividend approach would follow the same rationale, requesting citizen to take action over climate disasters and harm with purchasing and investment choices. In this way, the State would lose its main purpose, by disclaiming itself from its obligation of protecting its citizen.

Conclusions:

To conclude this line of thought, we postulate that Climate Income is not a broad solution (as thought by the USA branch of studies). Environmental regulation and control must be enhanced together with citizen empowerment, for legitimising their decision-making process over responsible choices of consumption.

Concerning its comparison with the option of Double Dividend and State’s welfare investment, Climate Income scatters individual choices, establishing a more democratic and debatable approach over society’s future changes. While it might lead to less rational choices and immediate results, it triggers a choice-legitimising debate for an awareness-responsibility path to be taken by citizen and consumers.

In this way, I conclude society can achieve an intertemporal, conscious, democratic Double Dividend.