Starting with some literature: What is a Financial Institution (FI)?

A financial institution (FI), according to Investopedia, is a corporation that undertakes financial and monetary transactions such as deposits, loans, investments and currency exchange. All people who live in a developed country have a constant need for the services offered by financial institutions. FI’s embrace a wide range of commercial transactions in the financial services sector, such as banks, trust companies, insurance companies, brokerage firms and investment operators.

Is there a relationship between Finance and Sustainability?

A research report of Deutsche Bank says: “There are a number of reasons why financial, environmental and social objectives can be consistent with each other and consideration for ESG (Environmental, Social and Governance) criteria can increase shareholder value. Moreover, it is likely that the avoidance of environment-related and social risks can reduce the company‘s reputational risk and its exposure to claims for damages.”

FI’s play a key role in advancing the CSR sector. Whether they decide to invest in a sector or not, they cause either an incredible development or a huge slowdown in the sector.

Moreover, the presence of sustainable or ‘green’ assets within an FI’s portfolio will indirectly affect the decisions of private investors to invest in this FI, or at least to build curiosities and encourage them to better understand the sustainability sector.

Over the past decade, there have been increasing efforts by financial institutions, as well as steps taken by central banks, financial regulators and market standard setters, to align the financial system with long-term sustainable development.

Thus, the transition towards a more sustainable path moved to an upper level when in 2015 the governments of the world reached three major agreements that set out their vision for the coming decades: a new set of 17 SDGs (Sustainable Development Goals), the Paris Agreement on climate change and the Financing for Development package.

Having understood that there is a positive relationship between FI’s investments in sustainability and the subsequent increase in shareholder value, the authors decided to submit a questionnaire to a specific group of young Europeans and non-Europeans between 18 and 35 years of age to better understand how and if sustainability and transparency can influence millennials and Generation Z in the choice of which financial institution they decide upon.

Why Millennials and Generation Z?

Millennials and Generation Z choices differ from previous generations in a variety of ways, especially for what concerns sustainable goods and services. Millennials represent the largest demographic in the workforce. Their habits can crucially influence market strategy. In this regard, 75% of them are willing to pay extra money to support eco-friendly products.

On the other side, people from Generation Z are the youngest of our target as well as the most aware when talking about environmental issues. In fact, a survey conducted by Amnesty International revealed that 41% of people aged between 18-25 years old conceived global warming as the most serious threat of our time, followed by pollution with 36%. The two topics are correlated with each other and arise the need of living in a more sustainable way.

However, being sustainable does not only mean buying less free-plastic items, toothbrush made of bamboo and adorn its own flat with plants. It also implies the support of institutes – such as banks – that are ethically nearer to the concept of green-thinking.

Here the results of the most relevant answers of the questionnaire.

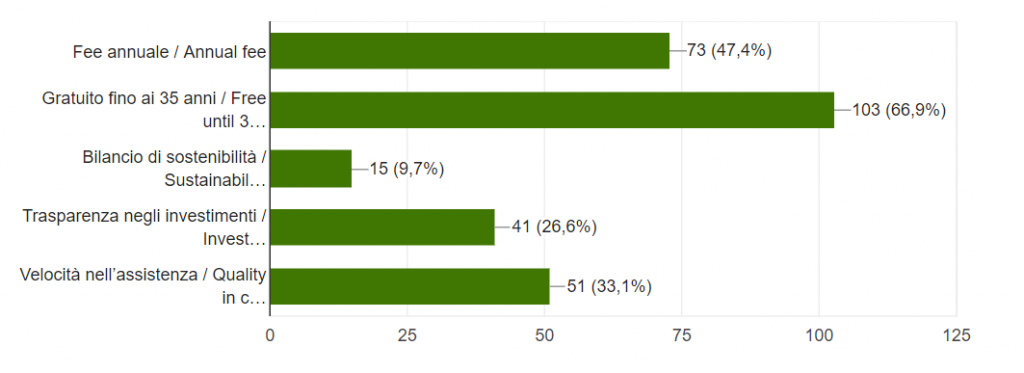

- When you decide to open a bank account, which factors do you usually consider?

According to the diagram, the economic aspect (Annual fee, Free until 35 yo) is the one that drives the consumer’s choice.

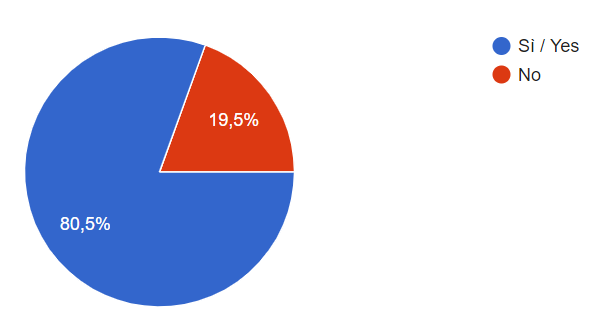

- Are you willing to pay a monthly fee to a bank that guarantees sustainable investments, transparency and whose aim is to reduce its environmental footprint? If so, what is your monthly willingness to pay?

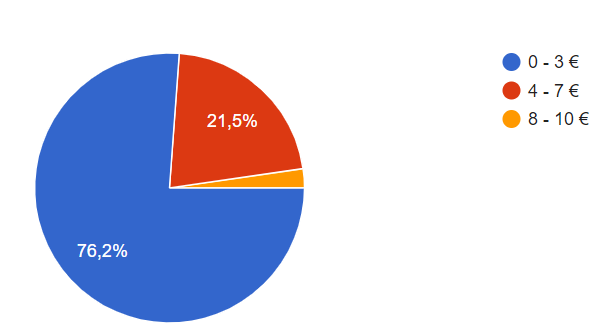

80,5% of interviewees are willing to support economically a bank that assures more sustainable services. The majority of them (76,2%) is open to contribute with a monthly fee that goes from zero to three euro, which is understandable, considering that 76% of the respondents age between 18 and 25 years old.

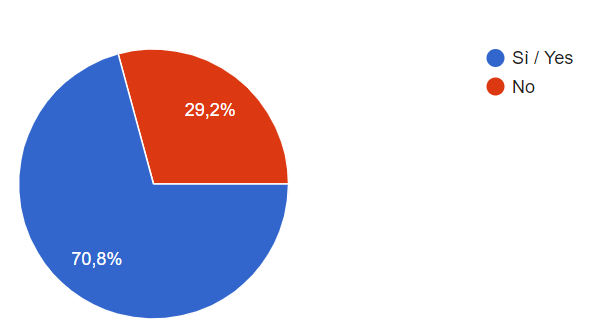

- If you found out that the bank that offers the best service/price ratio invests mainly in fossil fuels, would you rather close your bank account and open another one in a more sustainably focused bank?

The data is comforting, as almost 2/3 of respondents say they would like to join another bank if this one starts to move towards unsustainable investments.

In addition, the data provided could be a useful tool for those entities that are undecided about which type of interest to support. In fact, while 70,8% would be willing to change banks, investing in dirty goods would mean increasing the likelihood of losing that group of people who have recently entered the financial world and who, therefore, could be a long-term resource.

In conclusion, ESG (Environmental, Social and Governance) are three factors that can influence a user’s choice of an FI rather than another. This has led to the fact that some IFs today are a virtuous example of sustainable investment, transparency and integrated reporting.

This clearly shows that the commitment of IFs is going beyond financial activities towards a social respect and environmental protection. In addition, it is crucial to consider the fact that Millennials and Generation Z are very aware of environmental issues, which influence and shape their vision of “ethically correct” and, therefore, their consumption choices

This article has been written in collaboration with Marco Gervasi – MSc Student in Resource Economics and Sustainable Development